As developers at the heart of the Gitopia ecosystem, we understand the importance of transparency, especially when it comes to the fundamental aspects like tokenomics. Last year, we made crucial updates to our tokenomics model in Q4, which were not only announced and voted upon by our community but also marked a significant step towards refining our ecosystem’s economic design. Despite these updates being live on-chain, we recognized a gap—a single, comprehensive document that encapsulates these changes in one place.

This blog aims to fill that void, offering a comprehensive guide to the current Gitopia tokenomics. It presents an in-depth look at the active model, enriched with references and explanations for each decision.

Here, you’ll find a detailed breakdown of the Gitopia tokenomics as they stand today, along with insights into the thinking that guided these updates. We believe this document is crucial for investors, supporters, and the community members.

Detailed Tokenomics Changes:

There were two signifant changes in the tokenomics since we published the token model last year.

- Inflation Rate and Mechanism [proposal]

- Redristribution of Inflation Rewards for Platform Incentives[proposal]

Inflation Rate and Mechanism

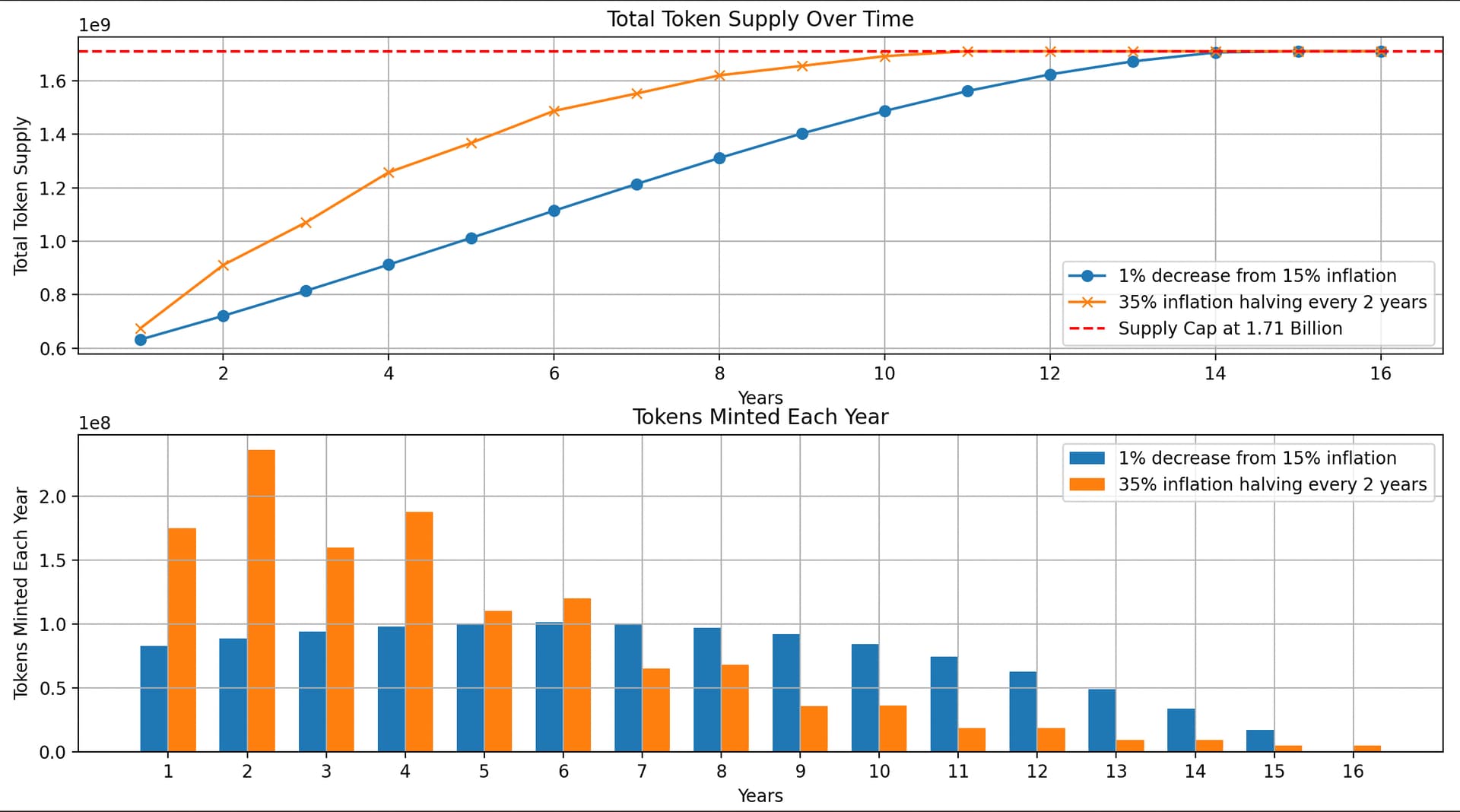

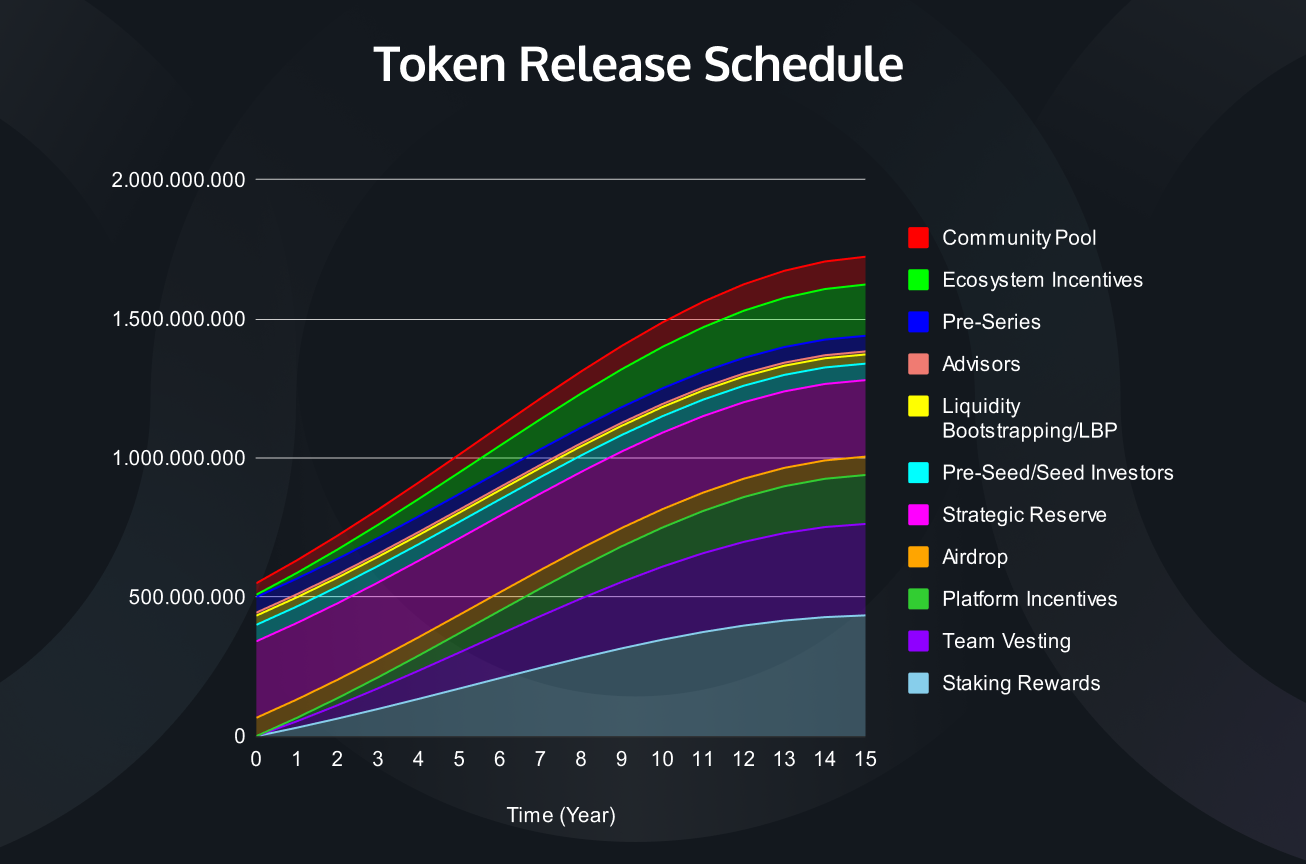

Initially, the Gitopia tokenomics was designed with an inflationary token model where the LORE token had a genesis supply of 500 million with a 35% inflation rate. This rate was set to halve every two years, aiming for a max supply of 1,711,136,433 $LORE tokens over a period of 11-years. This approach was geared towards incentivizing early network participation and rapid ecosystem growth.

Recent Changes

With the long-term vision and sustainability of the Gitopia ecosystem in mind, a governance proposal was passed with overwhelming support (99.35% Yes votes, with a turnout of 58.15%) to revise this model. The community agreed to a more sustainable inflation rate, initiating at 15% and decreasing by 1% annually until it gradually reduces to zero over a 16-year period, while still respecting the hard cap of 1,711,136,433 $LORE. You can see the difference between the two approaches in the image above.

| Aspect | Original Model | Current Model |

|---|---|---|

| Inflation Rate | 35%, halving every two years | Starts at 15%, decreasing by 1% annually |

| Period | 11 years | 16 years |

| Incentivization Focus | Early network participation and rapid ecosystem growth | Balanced long-term participation and sustainability |

| Inflation Reduction | Halving mechanism | Gradual annual decrease |

Rationale Behind the Update

The decision to adjust the inflation rate stems from a balanced strategy to encourage participation while managing token supply to prevent dilution. The updated model seeks to:

-

Incentivize participation: The modified inflation rate is designed to encourage active involvement within the Gitopia ecosystem by offering a more sustainable reward mechanism, balancing immediate engagement with long-term viability.

-

Ensure sustainability: By adjusting the inflation decrease to a gradual annual reduction, the updated model aims to maintain the ecosystem’s health and appeal to both current users and future developers, ensuring Gitopia’s enduring growth and stability.

Impact of the New Model

The revised inflation model aims for a steady growth in token supply, enhancing the ecosystem’s economic stability. It maintains the total supply ratio over the 16-year period, ensuring the proportion of tokens distributed remains consistent, thereby preserving community trust and honoring existing commitments. The extended timeline facilitates a smoother market absorption of the tokens.

Technical Implementation

Adopting this proposal required minor but crucial adjustments to the minting parameters, ensuring the smooth transition to the updated inflation model.

Redistribution of Inflation Rewards for Platform Incentives

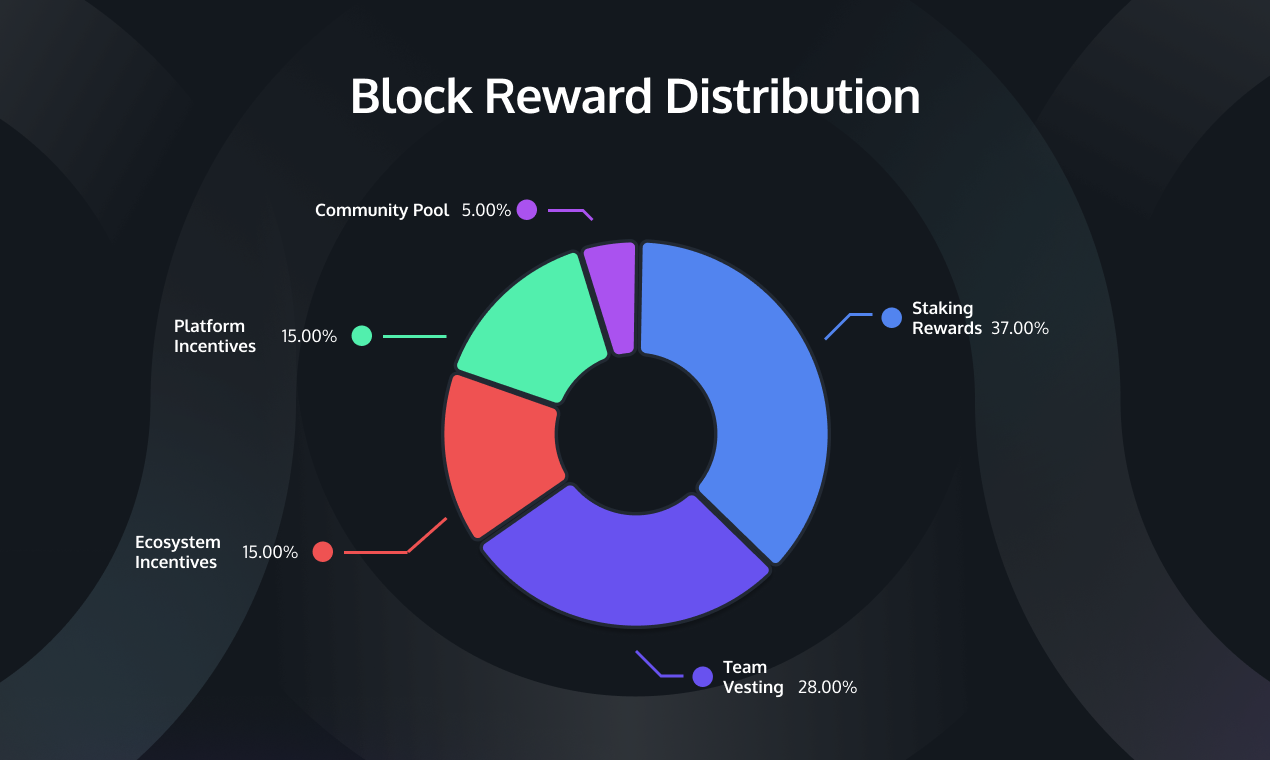

Recognizing the critical role of high-quality participation, a portion of the ecosystem incentives has been reallocated to establish a dedicated “Platform Incentives” pool. This shift aims to directly reward meaningful engagement and contributions, reflecting our commitment to the platform’s long-term growth and the value it delivers to its users. The adjustment resulted in the following changes:

- Ecosystem Rewards: Reduced from 30% to 15%.

- Platform Incentives: A new pool created, allocated 15% of inflation-based rewards.

Below is a detailed comparison of the original and new allocation of inflation rewards, outlining the phased approach we’re taking to implement these changes effectively.

Initial Allocation vs. New Allocation

| Allocation Category | Original Model | Current Model |

|---|---|---|

| Staking Rewards | 37% | 37% |

| Team Vesting | 28% | 28% |

| Ecosystem Incentives | 30% | 15% |

| Community Pool | 5% | 5% |

| Platform Incentives | N/A | 15% |

Phased Approach

- Phase 1 - Pool Reallocation: Implemented immediately after proposal acceptance. A new module address now collects 15% of inflation rewards for platform incentives.

- Phase 2 - Implementation and Oversight: Currently ongoing, featuring a 6-month period of manual oversight to ensure quality and gather insights for refining the incentive mechanism.

- Phase 3 - Automation: Plans to develop and deploy an automated disbursement system based on insights from Phase 2.

Rationale for Change

- Increased User Engagement: Motivating active participation on the Gitopia platform through direct incentives.

- Higher Quality Contributions: Implementing oversight and metrics to uphold contribution quality.

- Platform Growth: Promoting engagements that align with Gitopia’s long-term vision.

Addressing Risks

- Spam: Introducing governance oversight to deter low-quality contributions.

- Implementation Complexity: Developing a balanced and effective automated disbursement system.

Conclusion

This restructuring of rewards underscores our commitment to enhancing Gitopia’s value proposition. It balances the immediate need to incentivize platform usage with the long-term goal of ensuring contributions are valuable and relevant.

Note: Calculation for Phase 1 incentive distribution is complete, with distribution pending through a forthcoming proposal. Stay tuned to the social channels for updates and to contribute to the discussion on refining and automating platform incentives.

Miscellaneous Changes

Alongside the strategic shifts in incentive distribution, there have been several other miscellaneous yet significant changes to the Gitopia tokenomics structure.

| Aspect | Original Model | Current Model |

|---|---|---|

| Max Supply Timeline | 11 years to reach Hard Cap | 16 years to reach Hard Cap |

| Inflation Rate Reduction | Halving every two years | Decreasing by 1% each year |

| Team Vesting Schedule | monthly unlocks after cliff for 11-years | extended to 16-yesrs |

Time to reach Max Supply and Inflation Rate Adjustments

The original tokenomics model anticipated reaching the max supply of 1,711,136,433 LORE tokens within an 11-year timeframe. Instead of halving, the inflation rate will now decrease by 1% each year, smoothing out the inflation curve over a longer 16-year period.

Team Vesting Schedule Revision

Team tokens were allocated 28% of the block emission, with a vesting schedule that included a 12-month cliff followed by a monthly unlock rate of 0.834% post-vesting for 11 years.

To align with the extended inflation period, the team vesting schedule has also been extended to match the 16-year timeline. This change ensures that the team’s incentives are closely tied to the long-term success and development of the protocol. The extended vesting period reflects our commitment to stability and continuous improvement beyond the initial phases of the project.

The Live $LORE Token Model

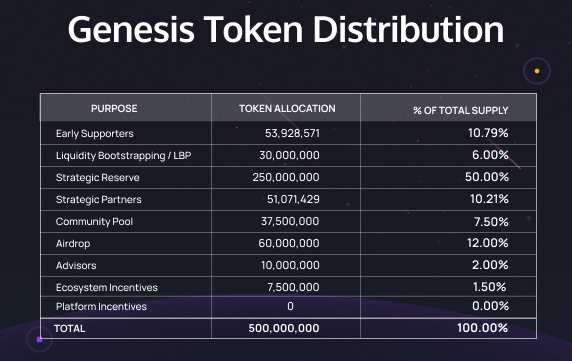

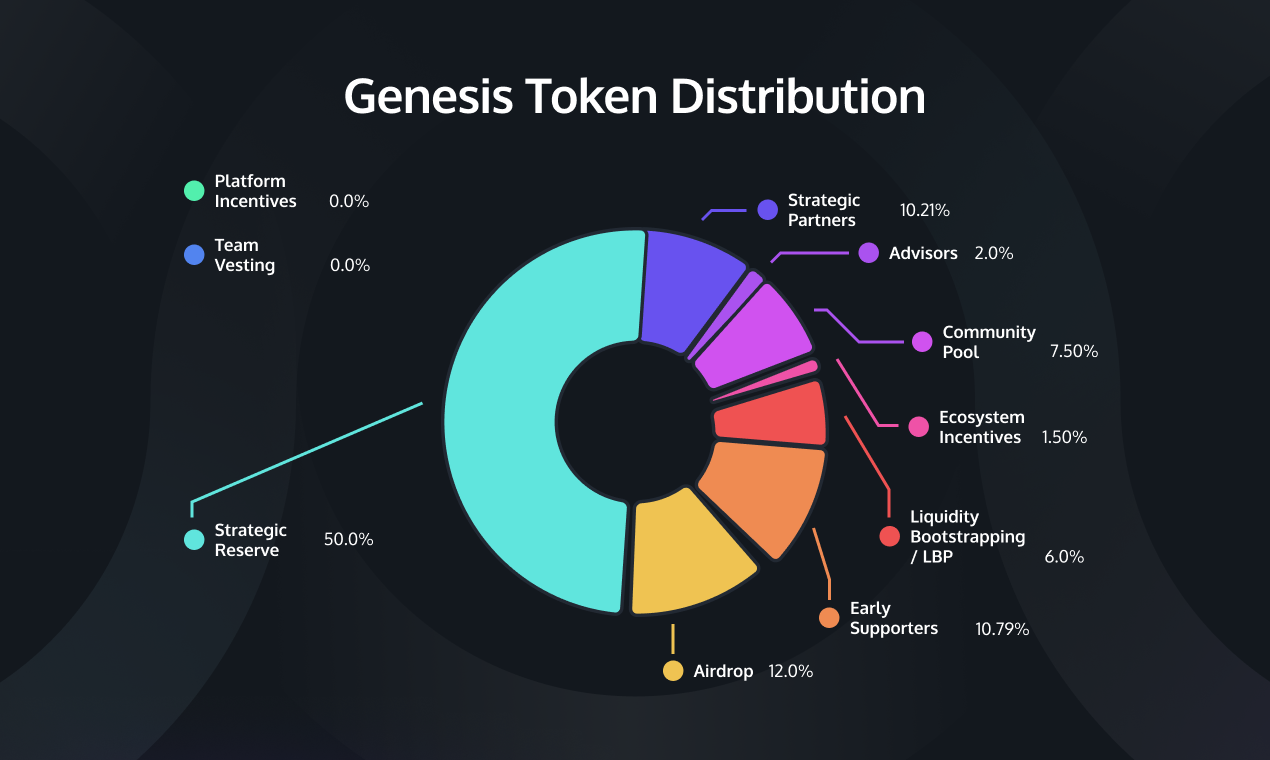

At inception, Gitopia’s native currency, the LORE token, was introduced with a genesis supply of 500,000,000 tokens. These tokens were meticulously pre-mined and earmarked for various strategic pools designed to secure the network’s future and empower its stakeholders.

Active Inflationary Model

Contrary to the initial 35% inflation rate set to halve biennially, the LORE token now adheres to a revised inflation model. This model starts at a 15% rate, diminishing by 1% each year, a gentle descent over a 16-year timeline, culminating in a hard cap of 1,711,136,433 tokens.

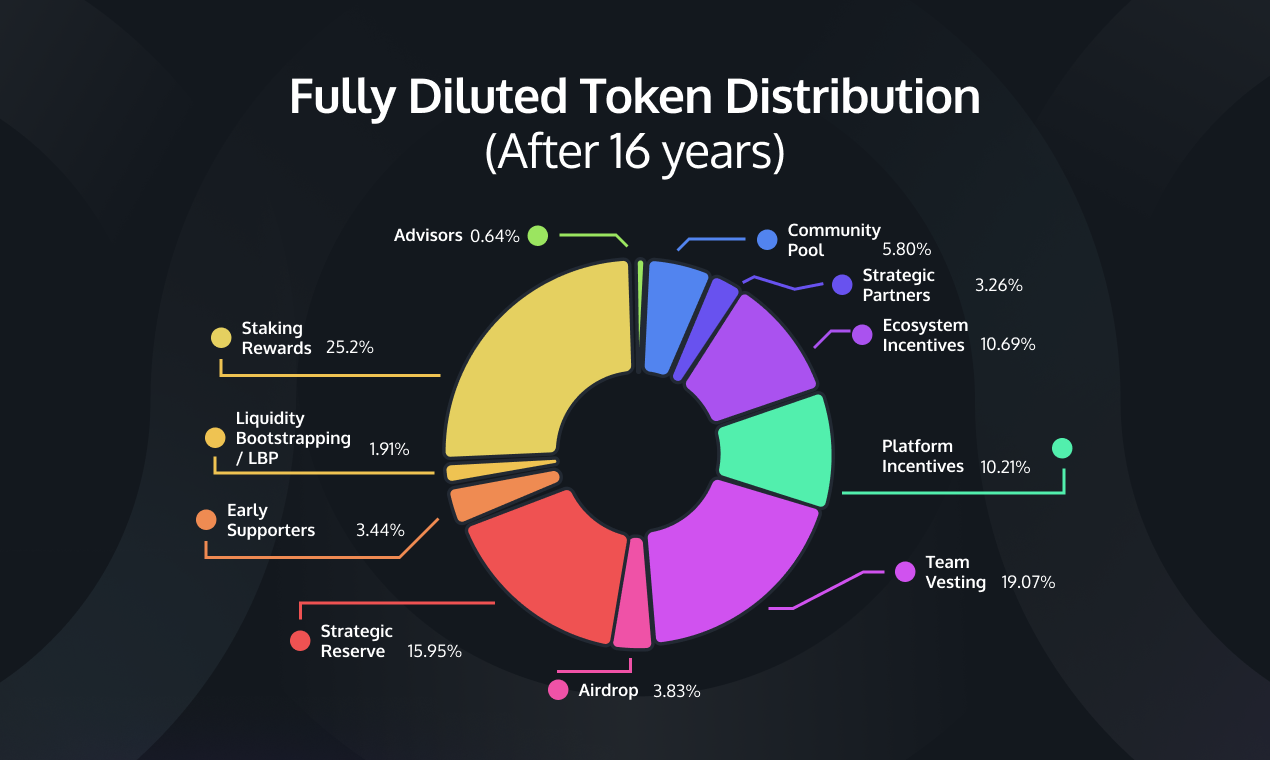

Token Allocation Pools

The newly minted tokens are now divided into five pools:

- Staking Rewards: 37%, incentivizing validators and delegators for maintaining network integrity.

- Team Vesting: 28%, designed to motivate and retain the core team with a 16-year vesting period aligning with the inflation timeline.

- Ecosystem Incentives: Now refined to 15%, focusing on fostering broader ecosystem engagement.

- Platform Incentives: A newly introduced pool constituting 15% of inflation-based rewards, encouraging quality contributions to the platform.

- Community Pool: 5%, governed by community proposals, supporting initiatives beneficial to the protocol’s growth.

Token Release Schedule

In the updated tokenomics framework, the release of $LORE tokens is carefully planned in alignment with the revised inflation rate, promoting a balanced and stable distribution of $LORE throughout the market. This approach ensures the ecosystem’s growth is supported by a steady and predictable supply of tokens.

Fully Diluted Token Distribution

The max supply of 1,711,136,433 LORE is expected to reach in 16 years, at which point the Fully Diluted Token Distribution will be as shown below:

Detailed Summary of Active Pools

The current tokenomics model includes the following pools, each with specific objectives and vesting conditions:

- Early Supporters and Strategic Partners: Recognized with allocations for their foundational contributions, governed by vesting schedules that reinforce long-term commitment.

- Liquidity Bootstrapping Pool (LBP): Ensures ample liquidity and facilitates Gitopia’s presence on decentralized exchanges, with funds allocated for this purpose from the genesis distribution.

- Strategic Reserve: A significant reserve to underpin Gitopia’s expansion, not just as a contingency but as a proactive driver of network growth, supporting everything from infrastructure to strategic partnerships.

- Advisors and Community Pool: Allocations to support expert advisory and community-driven projects, fostering a collaborative environment for innovation.

- Team Vesting: Reflecting a commitment to the project’s longevity, the team’s allocation is vested over an extended period, in line with the new inflation model.

Early Supporters:

The foundational bedrock of Gitopia was laid with the help of early supporters who now hold 53,928,571 LORE tokens. This allocation honors their pivotal role from legal groundwork to the deployment of the Gitopia testnets and further. These tokens are vested over a period with a 12-month cliff, followed by a bi-monthly 5% release, ensuring these early contributors’ continued alignment with Gitopia’s journey.

- Source of Supply: Genesis Distribution (53,928,571 $LORE)

- Vesting Schedule: 12-month cliff, 5% bi-monthly release thereafter

- Account type: Multisig

Strategic Partners:

This pool sets aside 51,071,429 LORE tokens for forming key partnerships that help grow and develop Gitopia. The allocation process is similar to early supporters, ensuring fairness and commitment as partnerships develop.

- Source of Supply: 51,071,429 LORE from Genesis Distribution

- Vesting Schedule: 12-month cliff and subsequent phased releases

- Account type: Module, allowing for flexible and adaptive governance

Liquidity Bootstrapping Pool (LBP):

A tactical pool of 30,000,000 LORE tokens is earmarked for liquidity strategies, pivotal for Gitopia’s market fluidity. Decentralized exchange initiatives, like the creation of LPs on platforms such as Osmosis, and so on .This pool is governed by community governance.

- Source of Supply: 30,000,000 LORE from Genesis Distribution

- Vesting Period: Immediate utility, no vesting

- Account type: Module, enabling dynamic utilization via governance as per liquidity needs

This fund may also be used for other avenues that enhance $LORE token liquidity.

Strategic reserve:

At Genesis, we have 250,000,000 LORE tokens to this strategic reserve, and this reserve is specifically designed to support the long-term expansion and adoption of the Gitopia ecosystem. This reserve is not a direct reward pool but a strategic fund for empowering essential network enhancements and fostering pivotal collaborations.

- Source of Supply: 250,000,000 LORE from Genesis Distribution

- Vesting Period: Non-vested, focused on strategic deployment

- Account type: Multisig

Some of the purposes of this pool include, but are not limited to:

-

Hiring agencies or services like auditing, security firms, etc., to ensure the highest standards for the Gitopia network.

-

Support validators through delegation who are highly active in the network.

-

Facilitating the onboarding of strategic partners to Gitopia.

-

Establishing future partnerships or acquisitions to enhance Gitopia’s suite of offerings for token holders.

-

Strategic delegations to onboard key validator partners.

-

Ensuring Gitopia remains competitive with existing code collaboration platforms by offering free services or resources to developers, such as storage, CI/CD minutes, and cloud services. This fund will be used cover the initial costs of maintaining a robust infrastructure for millions of potential users.

-

Funding tools, products, or use cases building on Gitopia blockchain.

-

Provide grants to developers or teams contributing to Gitopia.

To ensure the continued decentralization of the network, we will take a cautious approach to stake the strategic reserve, as we aim to prevent any single entity from gaining undue influence over the network.

Advisors:

For developing a protocol for the future to solve open-source problems, we would require a board of advisors who can help us brainstorm, ideate, build, or advise on how the key components of the network would function. Their vesting is designed to reflect their sustained advisory role, with a gradual release that aligns with strategic milestones.

- Source of Supply: 10,000,000 LORE from Genesis Distribution

- Vesting Schedule: 12-month cliff, 10% unlock every four months

- Account type: Multisig

This pool is reserved for us to make a long-term strategic board of advisory council or open-source consortium with popular projects on board, helping us make better decisions for the Gitopia ecosystem. Plans on this will be released as and when the work progresses.

Community Pool:

At the core of Gitopia’s democratic structure is the community pool, controlled entirely by community governance. With 37,500,000 LORE tokens plus a 5% share of inflation rewards, this pool fuels initiatives that enrich the protocol and its ecosystem.

- Source of Supply: 7,500,000 LORE from Genesis, supplemented by 5% of inflation rewards

- Vesting Period: No

- Account type: Module, Direct community proposals dictate allocation

These tokens can be allocated through governance proposals by the community on projects or initiatives that will benefit the protocol.

Team Vesting:

To sustain and incentivize the team behind Gitopia, 28% of block emissions are vested over an extended period. The team is incentivized through a structure that unfolds over a 16-year horizon, with no inflation rewards for unvested tokens, underscoring a long-term commitment to the project’s success.

- Source of Supply: No allocation from genesis, 28% of inflation rewards

- Vesting Schedule: 12-month cliff, followed by a monthly 0.834% release

- Account type: Module, ensuring alignment with protocol development

To ensure the interests of the protocol, there are steps taken for this pool, such as not taking staking rewards for unvested tokens and not taking rewards for the first cliff year. We will also implement a clawback mechanism that allows us to recover unvested team tokens in the event of a change in the development team. This step will ensure that only committed team members receive tokens and that unvested tokens do not end up in the wrong hands. These measures ensure that team members remain committed to the protocol’s success and act in its best interests.

Staking Rewards:

Staking forms the backbone of Gitopia’s security, rewarding validators and delegators alike. A total of 37% of block emissions will be distributed to validators and their delegators in proportion to contributions, reinforcing the network’s Proof-of-Stake consensus mechanism.

- Source of Supply: Block Emission (37.00%)

- Vesting Period: No

Ecosystem Incentives:

Gitopia’s ecosystem incentives are the engines of participation and innovation within the network. Initially commanding 30% of block emissions, this pool has been recalibrated to 15%, a reflection of Gitopia’s evolving strategy to invigorate its landscape while ensuring the incentives are precisely targeted.

- Source of Supply: Genesis Distribution (7,500,000 $LORE) and 15% of block emissions, redefined from the original allocation

- Vesting Period: No

- Account type: Module

These funds can be used for the following:

- Incentivizing liquidity pools in various decentralized exchanges.

- Incentivizing builders and external teams building and contributing on Gitopia.

- Provide additional rewards to some participants with exceptional contributions to the Gitopia ecosystem.

- Incentivizing tools, products, or use cases building on Gitopia blockchain.

- Fee grants for early adopters of Gitopia, supporting their initial costs and encouraging them to actively participate in the ecosystem’s growth.

Platform Incentives:

The introduction of platform incentives marks a strategic refinement in Gitopia’s tokenomics, carving out 15% of block emissions specifically to reward meaningful engagement with the Gitopia platform. This pool underpins our commitment to elevating the quality of open-source projects and collaborative efforts that are central to our ethos.

- Source of Supply: 15% of block emissions, a newly established pool to bolster high-quality platform engagement

- Vesting Period: No

- Account type: Module

The objective of this pool is to ensure that contributions are not only abundant but also of high caliber, thereby enhancing the intrinsic value of the Gitopia platform along with increasing the utility of $LORE. The distribution will initially be managed through governance proposals to maintain oversight and quality control, and then be transition to an automated system informed by defined metrics and community feedback.

Airdrops and Incentivization Programs:

This section outlines how 60,000,000 LORE tokens are allocated for airdrops and incentive programs to boost the Gitopia ecosystem by rewarding active contributions. Rewards are tied to specific tasks, ensuring they align with valuable ecosystem activities.

- Source of Supply: 60,000,000 LORE for airdrops and incentives.

- Distribution Strategy: Rewards are linked to contribution-based tasks.

- Account type: Module

Key Initiatives:

Game of $LORE Rewards: Allocates 2,250,000 LORE to reward participants of the Game of $LORE, split between contributors and validators.

Open-Source Contributor Airdrop: 7,750,000 LORE is set aside to encourage open-source contributors to join Gitopia, distributed across seven series of airdrops based on past GitHub contributions.

Cosmos Ecosystem Airdrops: Focuses on distributing 50,000,000 LORE to support projects within the Cosmos ecosystem, starting with Cosmos Hub, Osmosis, and Akash Network, to foster collaboration and growth.

Future Plans:

An additional 41,000,000 LORE is reserved for expanding Gitopia’s interchain collaborations, with allocations determined through community governance. This strategic approach aims to enhance Gitopia’s integration within the Cosmos ecosystem and beyond, promoting a decentralized and collaborative platform for developers.

NOTE: Unallocated rewards from these initiatives will contribute to the community pool, ensuring continuous support for future projects and growth. All airdrop recipients will be required to complete a series of specific tasks to unlock the airdrop rewards. Further information regarding the airdrops and tasks will be announced in an upcoming announcements.

Conclusion:

The updated Gitopia tokenomics, shaped with input from our community, establishes a foundation for sustainable growth, aligning incentives with the long-term objectives of our ecosystem. This dynamic framework grants the community governance powers to refine and adjust the allocation and functionality of token pools, ensuring Gitopia remains responsive to evolving needs and opportunities.

With these revisions, we aim to fortify the ecosystem’s economic health, fostering a balance between rewarding contributions and ensuring stability. As we move forward, these adjustments are expected to cultivate a stronger, more secure network that encourages valuable contributions and active engagement from everyone involved. Our journey ahead is shaped by collective decisions, reinforcing our commitment to a decentralized future where the community leads the way in steering Gitopia’s evolution.

About Gitopia

Gitopia is the next-generation Decentralized Code Collaboration Platform fuelled by a decentralized network and interactive token economy. It is designed to optimize the Open-source software development process through collaboration, transparency, and incentivization.

Follow us

Website: https://gitopia.com/

Whitepaper: https://gitopia.com/whitepaper.pdf

Telegram: https://t.me/Gitopia

Discord: https://discord.com/invite/mVpQVW3vKE

Twitter: https://twitter.com/gitopiaDAO

Forum: https://forum.gitopia.com/